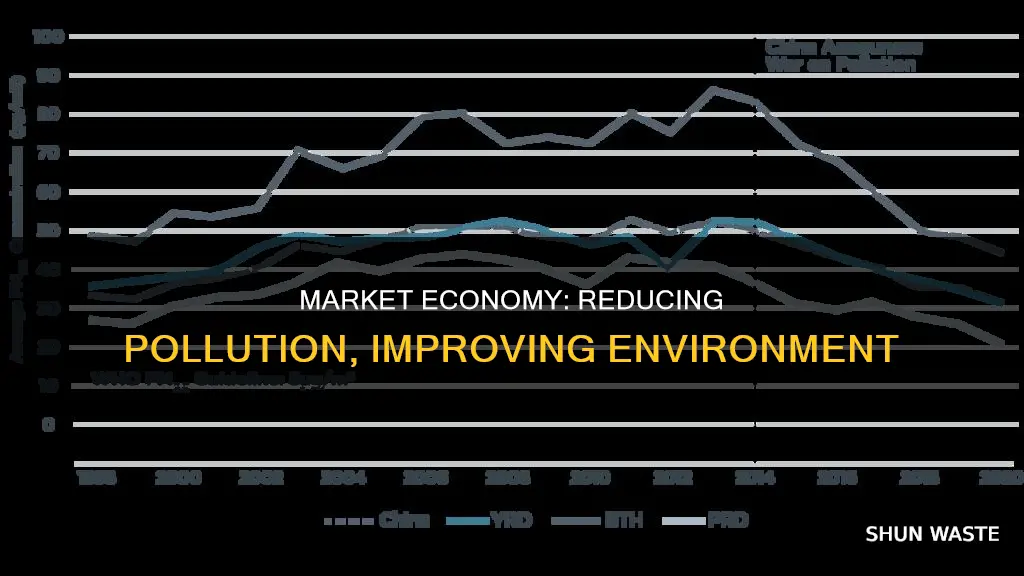

Market economies are better at reducing pollution because they incentivize firms to innovate and create more efficient products. For example, the Clean Air Act in the US has successfully reduced pollution while fostering economic growth. This has been achieved through various market-based approaches, such as economic incentives, taxes, and tradable permits. These approaches provide financial motivation for firms to reduce emissions and develop cleaner technologies. While traditional regulatory approaches can be effective, market-based approaches offer more flexibility and continuous inducements for firms to improve their production processes and reduce pollution.

| Characteristics | Values |

|---|---|

| Market-based policies | Rely on market forces to correct for producer and consumer behaviour |

| Traditional regulatory approaches | Set specific standards across polluters |

| Performance-based standards | Allow polluters to choose any available method to meet the emissions standard |

| Emission taxes, fees and charges | Place a per-unit monetary charge on pollution emissions or waste to reduce the overall quantity |

| Subsidies | Forms of financial government support for activities believed to be environmentally friendly |

| Tax-subsidy combinations | Deposit-refund systems that first initiate a product charge or tax, and then reward the consumer for recycling or properly disposing of the product |

| Combining standards and pricing approaches | Pollution standards set specific emissions limits, and emission taxes restrict costs by allowing polluting sources to pay a tax on the amount they emit |

| Liability rules | Hold polluters accountable for the proper management, disposal, cleanup, and remediation costs of their waste or emissions |

| Information disclosure | Influence firm behaviour through the dissemination of information on items such as production processes, labour standards, and pollution levels, to the federal, state and local government agencies, or to the public |

| Free-market solutions | Technological development and falling costs of solar power mean that cleaner energy is now more competitive than many fossil fuels |

What You'll Learn

- Market-based policies incentivize firms to reduce pollution by creating a financial incentive to pollute less

- Tradable permits allow firms to trade permits with each other, which can be an effective tool for pollution control

- Green taxes can be implemented on emissions, production inputs, or consumer goods to reduce pollution

- Subsidies can be offered by the government to incentivize the use of alternative energy sources

- Regulations can be imposed to ban certain pollutants and set clear goals for reducing pollution

Market-based policies incentivize firms to reduce pollution by creating a financial incentive to pollute less

Market-based policies are an effective way to incentivize firms to reduce pollution by creating a financial incentive to pollute less. These policies rely on market forces to correct the behaviour of producers and consumers, encouraging them to make decisions that take into account the environmental impact of their actions.

Market-based approaches provide continuous inducements, both monetary and non-monetary, for firms to reduce their emissions. For example, firms can be rewarded with grants, low-interest loans, favourable tax treatment, or procurement mandates when they reduce emissions. These incentives create a win-win situation where firms benefit financially while also improving the environment.

A key advantage of market-based policies is that they give firms the flexibility to choose the most cost-effective methods of pollution reduction. Firms will voluntarily reduce emissions as long as it makes financial sense for them to do so, and this generally happens when marginal abatement costs are balanced across all regulated firms. This flexibility encourages innovation and the adoption of cleaner technologies, as firms strive to find the least costly methods of pollution abatement.

Market-based policies have been successfully applied in various sectors, including electricity generation. For instance, the US Acid Rain Program, a cap-and-trade system, effectively reduced sulfur dioxide emissions from electric utilities. This approach allowed firms to either reduce their emissions directly or purchase pollution allowances from other firms that had exceeded their reduction targets.

In addition to direct financial incentives, market-based policies can also influence consumer behaviour. By making consumers aware of the environmental impact of their choices, they can encourage the purchase of products from regulated firms, further incentivizing firms to reduce pollution.

However, it is important to note that market-based policies may not always be suitable for addressing all environmental issues. One potential drawback is the risk of concentrating pollution in economically disadvantaged areas, known as "pollution hotspots." Therefore, the selection of the appropriate market-based incentive depends on various factors, including the nature of the environmental problem, the degree of uncertainty, and the goals of policymakers.

Cap and Trade: Reducing Air Pollution, How?

You may want to see also

Tradable permits allow firms to trade permits with each other, which can be an effective tool for pollution control

Tradable permits, also known as marketable permits, are a type of economic incentive or market-based policy that can be used to reduce pollution. This approach allows firms to buy and sell permits to pollute, creating an incentive for them to reduce their emissions. The basic idea is that if a firm can reduce its emissions below the required level, it can sell its unused permits to another firm that is unable to meet its emissions targets. This system provides a financial reward for firms that successfully reduce their pollution levels and encourages innovation in pollution abatement technologies.

The United States was the first country to implement tradable permits as a prominent feature of its environmental protection programs. One example is the US Acid Rain Program, a cap-and-trade system that successfully reduced sulfur dioxide emissions from electric utilities. Under this program, emissions allowances are calculated based on allowable emissions per million British thermal units (Btu) times average Btu consumption. Plants with emissions below the allowable limit can trade permits with plants that exceed their allowances. The US Environmental Protection Agency (EPA) also holds some allowances, which it offers at annual auctions. This trading program has resulted in significant cost savings, estimated at approximately $2.5 billion per year compared to the costs without trading.

Another example of a successful tradable permit system is the Regional Clean Air Incentives Market (RECLAIM) in Southern California. This program establishes emissions allowances for NOx and SOx, and sources are allowed to trade emissions reduction credits. Trading ratios are set for trades between different geographic areas to ensure no net increase in overall emissions. RECLAIM has been estimated to reduce compliance costs by nearly 50% through trading.

Tradable permits offer several advantages over traditional command-and-control approaches to pollution reduction. They provide continuous incentives for firms to incorporate pollution abatement into their production and consumption decisions. Firms have the flexibility to either reduce their own emissions or purchase pollution allowances from other firms. This can result in cost savings for both firms and customers, leading to lower overall social costs. Tradable permits also encourage innovation, as firms have a financial incentive to search for the least costly and most effective methods of abating pollution.

However, it is important to consider some potential drawbacks and limitations of tradable permit systems. One concern is the possibility of creating environmental "hot spots" where pollution becomes concentrated in certain areas due to the trading of permits. Additionally, tradable permit systems may not be suitable for addressing environmental issues that raise equity concerns or have significant social impacts. The design and implementation of these systems require careful consideration of factors such as the nature of the environmental problem, monitoring and enforcement issues, and potential market distortions.

Trees: Our Allies in the War Against Pollution

You may want to see also

Green taxes can be implemented on emissions, production inputs, or consumer goods to reduce pollution

Market economies are better at reducing pollution as they incorporate incentives to reduce costs. Markets exist when buyers and sellers interact, and this interaction determines market prices and allocates scarce goods and services. In a market economy, the government plays a role when the benefits of a policy outweigh its costs.

Green taxes are fiscal policy measures imposed by governments to promote environmentally friendly behavior and address environmental issues. They are designed to internalize the external costs associated with activities, products, or services that have negative environmental impacts. Green taxes can be implemented on emissions, production inputs, or consumer goods to reduce pollution. Here are some examples:

Emissions

Carbon taxes are imposed on the carbon content of fossil fuels to incentivize the reduction of greenhouse gas emissions. By making carbon-intensive activities more expensive, these taxes encourage individuals and businesses to transition to lower-carbon alternatives. This type of tax shifts economic incentives towards more environmentally friendly practices and can be an effective tool in achieving climate goals.

Production Inputs

Landfill taxes are imposed on waste disposal in landfills, encouraging waste reduction, recycling, and responsible waste management practices. By making waste disposal more costly, businesses and consumers are incentivized to reduce waste and adopt more sustainable practices.

Consumer Goods

Plastic bag taxes are often applied at the point of sale to discourage the use of single-use plastic bags and promote reusable alternatives. This type of tax directly influences consumer behavior and can lead to a significant reduction in plastic waste.

Other Examples of Green Taxes

- Congestion charges in urban areas to reduce traffic and air pollution

- Pigouvian taxes, named after economist Arthur Pigou, are designed to correct market failures by internalizing external costs, such as taxing activities that produce pollution.

- Windfall taxes on excess profits of companies in certain sectors

- VAT reductions or exemptions on "clean" technology, such as solar panels

- Increased tax rates on polluting activities, such as vehicle emissions or fossil fuel usage

Reducing Air Pollution from Agro-Industries: Strategies and Solutions

You may want to see also

Subsidies can be offered by the government to incentivize the use of alternative energy sources

Market economies can be effective at reducing pollution, and governments can play a role in this by offering subsidies to incentivize the use of alternative energy sources. Subsidies are financial incentives offered by the government to encourage activities that are believed to be environmentally friendly. In the context of energy, subsidies can be provided to promote the adoption of renewable and alternative energy sources, reducing the reliance on more polluting options.

The US federal government, for example, offers various tax credits, grants, and loan programs to support renewable energy technologies and projects. This includes initiatives such as the Renewable Electricity Production Tax Credit (PTC), the Investment Tax Credit (ITC), and the Residential Energy Credit. These subsidies aim to make renewable energy more affordable and accessible, reducing the barriers to adoption for consumers and businesses.

State governments also play a significant role in promoting alternative energy sources through subsidies and incentives. Many states have established renewable portfolio standards (RPS), which require a certain percentage of electric power sales to come from renewable sources. To comply with these standards, utilities may trade renewable energy certificates (RECs), allowing them to support the development and consumption of renewable energy.

In addition to tax credits and grants, loan programs also play a vital role in encouraging the adoption of alternative energy sources. The US Department of Energy (DOE), for instance, administers loan guarantee programs such as the Title XVII Innovative Technology Loan Guarantee Program. These programs provide financial support for innovative clean energy technologies that might not otherwise qualify for conventional private financing due to their high technological risks.

Subsidies can also take the form of feed-in tariffs (FITs), where states or electric utilities offer special rates for purchasing electricity generated from renewable sources. FITs are designed to encourage new projects and investments in specific types of renewable energy technologies.

The impact of these subsidies is evident in the growing adoption of renewable energy sources. In 2017, wind and solar energy represented almost half of the new electricity generation capacity in the US. This shift towards renewable energy has helped to reduce pollution and improve air quality, as seen through initiatives like the US Clean Air Act, which has successfully reduced air pollution while fostering economic growth.

By offering subsidies and incentives, governments can play a crucial role in accelerating the transition to a cleaner and more sustainable energy future, reducing pollution and mitigating the impacts of climate change.

Astronomik DSLR Clip-on: Reducing Light Pollution?

You may want to see also

Regulations can be imposed to ban certain pollutants and set clear goals for reducing pollution

Another example of successful regulation is the Diesel Emissions Reduction Act (DERA), which provides funding for owners to replace their diesel equipment with less polluting alternatives. This has led to significant reductions in NOx and particulate matter pollution, resulting in improved air quality and substantial health benefits.

Regulations can also take the form of economic incentives or market-based policies. These approaches use market forces to encourage producers and consumers to reduce harmful emissions. For instance, the United States Acid Rain Program, a cap-and-trade system, has effectively reduced sulfur dioxide emissions from electric utilities. Market-based approaches create an ongoing incentive for firms to incorporate pollution abatement into their production and consumption decisions, driving innovation in cost-effective pollution reduction methods.

In summary, regulations play a crucial role in reducing pollution by setting clear goals and providing incentives for polluters to adopt cleaner technologies and practices. Both traditional regulatory approaches and economic incentive policies have proven effective in improving air quality and protecting public health, demonstrating that market economies can successfully reduce pollution through the implementation of well-designed regulations.

Portland's Air Quality Strategies: A Guide to Success

You may want to see also

Frequently asked questions

A market economy is an economic system where the production and exchange of goods and services are determined by the interactions of buyers and sellers in a market, rather than by central planning. Market economies are typically characterised by private ownership, freedom of choice, and the presence of competition.

Market economies provide incentives for firms and consumers to reduce pollution. For example, firms may be incentivised to develop and adopt cleaner technologies, while consumers may be incentivised to switch to less polluting products or behaviours. Market-based approaches, such as taxes, subsidies, and tradable permits, can be used to correct for producer and consumer behaviour, internalising the negative externalities associated with pollution.

Market-based approaches provide continuous inducements, including monetary incentives, for polluting entities to reduce harmful emissions. This creates an incentive for the private sector to innovate and incorporate pollution abatement into production and consumption decisions. Market-based approaches can also lead to cost savings for firms and consumers, as well as stimulate economic growth and job creation.

Yes, there are potential drawbacks and limitations to consider. Market-based approaches may face political resistance, as people may be reluctant to pay new taxes or accept certain costs associated with pollution reduction. Additionally, there is a risk of inequitable outcomes, with pollution potentially being concentrated in economically disadvantaged areas. Furthermore, market-based approaches rely on accurate measurement and monitoring of emissions, and there may be challenges in enforcing compliance.